a yearly tax credit for washingtonians

Don’t miss out on claiming your Working Families Tax Credit. Up to $1,290 cash back in your pocket, for working people and families across Washington State.

What is the Washington Working Families Tax Credit?

The Working Families Tax Credit is a new annual tax refund for Washington residents worth $50-$1,290 depending on your income level and how many qualifying children you have in your household. Undocumented workers and other who use an Individual Taxpayer Identification Number to do their taxes are eligible for this payment. Check if you are eligible and apply today – you have three years to claim your credit.

Working Families Tax Credit Details

This money belongs to you

An annual cash refund of up to $1,290 for eligible Washingtonians. You must file your federal taxes, and submit an application for this state refund.

Immigrants are included

Undocumented workers and other who use an Individual Taxpayer Identification Number to do their taxes are eligible for the Working Families Tax Credit.

You can apply all year

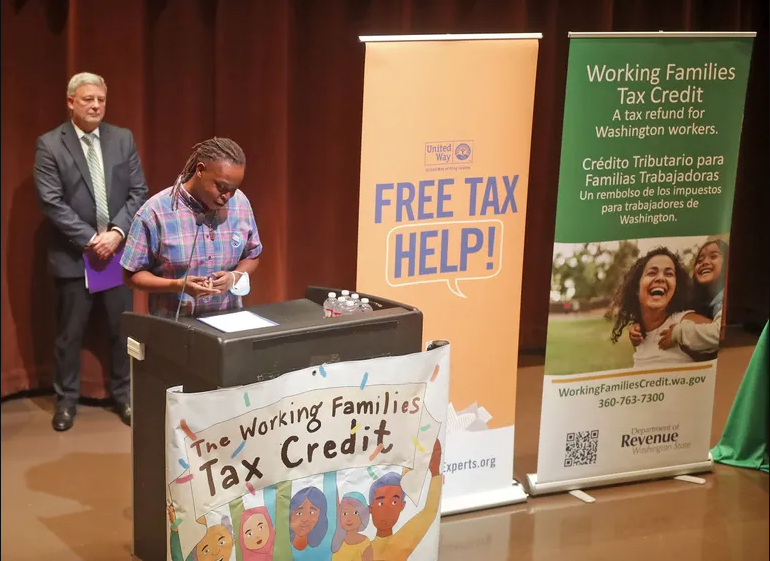

Applications are open all year long. Apply for free through the Department of Revenue, or get free help applying at a free tax prep location.

Find Free Tax Prep

The first step in applying for the Working Families Tax Credit is to complete your federal tax return. Even if you don’t usually file because your income is too low, doing your taxes could get you thousands of dollars in cash back through the Earned Income Tax Credit and Working Families Tax Credit.

Have questions about your Working Families Tax Credit application status?

If you have questions about your Working Families Tax Credit application status, contact the Department of Revenue’s Working Families Tax Credit help line, open Mon-Fri 8am – 5pm: 360-763-7300. Press 2 for Spanish, and stay on the line for other interpretation services.

In the News

-

Yakima families benefit from newly implemented Working Families Tax Credit: Thousands still eligible to apply | KIMA (kimatv.com)

Read More: Yakima families benefit from newly implemented Working Families Tax Credit: Thousands still eligible to apply | KIMA (kimatv.com)YAKIMA – For the first time this year, families were able to apply to get over a thousand dollars back through the Working Families Tax Credit (WFTC). The program is designed to give $300 to $1,200 per year back to nearly 400,000 taxpayers to help balance Washington’s “upside down tax code.”

-

WA’s low-income tax credit, established in 2008, available for first time

Daniel Gutman | Seattle TimesRead More: WA’s low-income tax credit, established in 2008, available for first timeUp to $1,200 is now available for hundreds of thousands of low-income working Washington families, thanks to a 2008 law that — 15 years later — is finally funded for the first time.

-

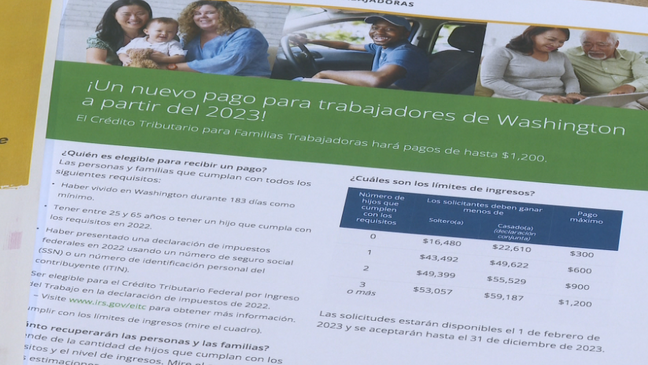

Nuevo pago financiero para las personas y familias que viven en Washington

Michelle Reyes | KUNW | UnivisionRead More: Nuevo pago financiero para las personas y familias que viven en WashingtonA partir del primero de Febrero de 2023, el Working Families Tax Credit (crédito tributario de la familia trabajadora), proporcionará pagos de hasta $1,200 a las personas que cumplan con ciertos requisitos de elegibilidad.

Working Families Tax Credit Coalition

The Working Families Tax Credit Coalition is a coalition of organizations spanning economic and racial justice groups, immigrant rights advocates, labor, direct service providers, domestic violence advocates, and more.

Our goal is working together to make sure communities most impacted by Washington’s upside down tax code receive cash in hand.